By Alonso Munoz, Sambhav Bansal, Alexander Canacci

When it comes to retirement plans, we usually refer to either Defined Contribution or Defined Benefit Plans. The most common workplace retirement plan is the Defined Contribution plan. This is your basic 401(k)! As the name suggests, the amount you can “contribute” to the Plan in any given year is “defined”; this is referred to as your deferral. Most modern 401(k) Plans are participant directed, meaning the participant (employee) bears the investment risk, and there is no guarantee as to what the plan will be worth upon retirement. The participant chooses how much they contribute and what to invest in. On an annual basis, the IRS updates the annual contribution limits to these Plans, commonly known as Cost of Living Adjustments (COLA).

The second type of retirement plan is a Defined Benefit Plan. These are your traditional pension plans that usually pay the participant (employee) a certain amount of money upon reaching retirement age or time in-service, thus the benefit is “defined”. In general, employers lean toward defined contribution plans as the burden of how much the employee has for retirement shifts from the employer to the employee. As a result, the traditional “pensions” have fallen out of favor over the years (think- IBM/GM/ FORD/P&G).

Over the last decade, Congress, and the Federal government (alongside industry lobbyists) have made an effort to incentivize SMBs (Small to Medium Sized Businesses) to adopt modern pension Plans for the benefit of both the employer and the employees. With the average U.S worker lagging in “retirement readiness”, these new incentives serve to bridge the gap for many working Americans. These newer plans are referred to as Cash Balance Plans.

Why establish a Cash Balance Plan?

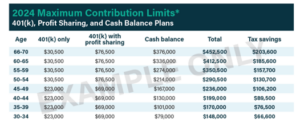

Large Retirement Contributions: The IRS contribution limits determine how much you can put into the plan every year. In a CB plan, these limits are much higher than what a “defined contribution” plan usually offers. Since the limits are higher, CB plans have the potential for contributions in the six-figure range. Actuarial calculations state that the higher the salary and the older an owner is, the more they can defer to the cash balance annually.

Tax Efficiency: For business owners running a CB Plan, there’s a significant opportunity for tax deductions and deferrals. Owners of a CB can reduce their taxable income for every dollar contributed to the plan. It’s considered a deduction under the Pension, profit-sharing, etc., plans line on a tax return. Furthermore, CBs are IRS/ERISA qualified plans that offer tax-deferred retirement contributions for owners. In many cases, owners can double or triple their pretax deferrals by sponsoring a CB Plan.

Rollover: When the plan closes or when an employee leaves, the vested portion of the account can be rolled over into an IRA or 401(k). Since CB plans typically have higher limits than either of those, a smart investor can effectively increase their 401(k) or IRA contributions above traditional allowances.

Employee Benefit Appeal: As part of a company’s benefit package to employees, the Cash Balance Plan can prove to be a strategic advantage, especially at small and mid-sized businesses, when recruiting talent and reducing employee attrition.

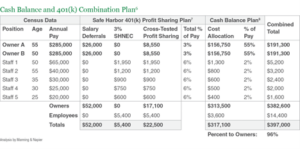

Cash Balance Plans can be set up in combination with a 401(k). Below is an example of what this looks like in practice:

Notable Highlights:

- Annual Employer Contributions: The account is credited annually with an employer contribution (deduction) which is determined by a formula specified in the Plan Document. The amount is typically a percentage of salary, although it may also be a flat dollar amount. In the above example, the owners can contribute 6x more than what only a 401(k) plan would allow for.

- Investment flexibility: All Plan assets are invested collectively by a plan Trustee and appointed fiduciary in one pooled account.

- Accounts are portable: When an employee leaves an employer, the vested portion of the account can be taken as a lump sum or rolled over to an IRA.

- Legal Protection: Cash Balance Plans are IRS/ERISA qualified Plans, and Plan assets are protected from bankruptcy and lawsuits.

Takeaway:

Cash Balance Plans have been around for many years and have experienced renewed popularity among small- to mid-sized businesses since the passage of Pension Protection Act of 2006 (PPA). Cash Balance Plans are Defined Benefit Plans with more efficient portability, lower risk, and more transparency. Cash Balance Plans help employers control the cost of benefits more so than a traditional Defined Benefit Plan using a uniform benefit formula. When aggregated for testing purposes, a Cash Balance and 401(k) Combination Plan arrangement can provide extreme flexibility in controlling costs and maximizing benefits for business owners.

Source: FuturePlan by Ascensus, LLC

Supporting Legislation:

2006 PPA: Pension Protection Act: IRS Approval and recognition of legal status.

2010 IRS Cash Balance Regulations: ICR (Interest Crediting Rates) made these Plans even more attractive to employers and business owners.

2014 Final IRS Cash Balance Regulations: This round of regulation added increased investment flexibility and clarified compliance regulations.

6 Assumes a benefit based on 7% of average monthly compensation multiplied by a maximum of ten years of participation, and a Target Normal Cost calculated using mandated segment rates for January 2020.

7 A 3% Safe Harbor Non-Elective employer contribution is allocated to all eligible participants plus a 3% regular employer Profit Sharing allocation to non-owner participants. Complying with Safe Harbor provisions allows the owners to make maximum salary deferrals without failing required non-discrimination testing.

8 Profit Sharing, Safe Harbor, Salary Deferral and Cash Balance allocations are converted to monthly benefits at age 65 (Normal Retirement Age) and aggregated to pass non-discrimination testing.

* This material has been prepared for informational and illustrative purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You or your client should consult your/their own tax, legal, and accounting advisors before engaging in any transaction.

This commentary reflects the personal opinions, viewpoints and analyses of the Hamilton Capital Partners, LLC, a registered investment advisor, employees providing such comments, and should not be regarded as a description of advisory services provided by Hamilton Capital Partners, LLC or performance returns of any Hamilton Capital Partners, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Hamilton Capital Partners, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.