By Kelvin Lee

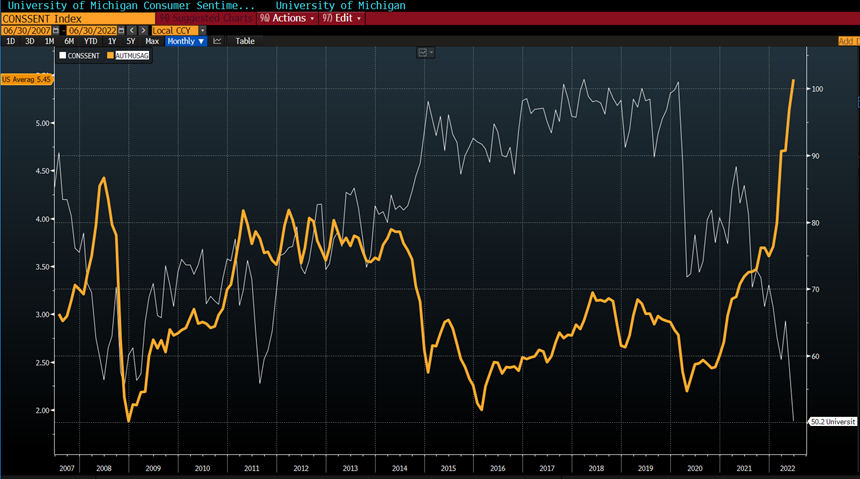

Created in 1940 by University of Michigan Professor George Katona, the Michigan Consumer Sentiment Index (MCSI) and the Michigan Inflation Expectations track a monthly survey of randomly sampled consumers on their current financial conditions and outlook on the economy. Since roughly 70% of Gross Domestic Product is derived from consumer spending, the general attitude of consumers is a useful economic indicator. Fed Chairman Jerome Powell mentioned in his June meeting that the central bank is factoring these survey results in their next rate hike decision and investors are watching closely for guidance on corresponding policy moves. This goes hand in hand with the Federal Reserve’s task dilemma: how do they reduce headline inflation when they can only influence core CPI? Recall, the federal reserve implements monetary policy and cannot impact supply. It’s a point of contention with the University of Michigan studies as consumer sentiment and inflation expectations are currently being driven by rising oil prices, which is outside the Fed’s control. The below graph illustrates this relationship by tracking median gas prices and the MCSI. Not surprisingly, there’s a negative correlation; consumer sentiment falls as gas prices rise. Our base case for Friday is that sentiment numbers will be lower than the shocking 50.2 preliminary results we saw earlier this month. The June 10th MCSI data reflected queries conducted from late May to June 8th when median gas prices were roughly $4.75. Gas prices have risen north of $5 a gallon since then. We expect Friday’s Michigan print to echo this as it will reflect surveys gathered during the subsequent June 8th to June 20th period. The FOMC will be watching, and after Powell’s hawkish testimony on the senate floor this week, a 75-basis point hike in July is becoming more likely.

* Source: Bloomberg

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com