By Kelvin Lee, Alonso Munoz

Following the record Black Friday and Cyber Monday sales last week, the “Strong U.S. consumer” headline has resurfaced once again. People are buying things, which means the economy is strong…right? Well, our investment team aligns with what billionaire hedge fund manager Ken Griffen said earlier this month: The U.S. needs to stop spending like a ‘drunken sailor’.

Let’s dive into the Adobe holiday numbers from November. Over $109.3 billion in revenue was raised from shoppers, a record spend season and 5% more than 2022. We’re glad that everyone got their Christmas gifts early this year, but it looks like that strong spending was facilitated by credit.

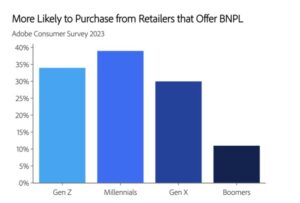

Buy Now Pay Later (BNPL) programs accounted for $8.3 billion of sales, the largest BNPL month ever recorded and 23% more than November of 2022, the second largest month at $6.7 billion. Short term financing doesn’t scream a “confident consumer”, but rather a weaker one. While BNPL looks attractive with easy approval and soft credit checks, it preys on desperate buyers likely to miss payments, the catalyst for a cycle of high interest payments and falling credit scores. Furthermore, Millennials and Gen Z are the biggest drivers for BNPL. Look at the Adobe respondent results. More than 1 in 3 millennials are planning to use BNPL for their gifts this holiday. 1 in 3! The constant assault of Karma and Affirm advertisements in online shopping is influencing our most susceptible younger generations. A disheartening fact about the rise in BNPL activity is that its growth has been greatest for groceries. Customers financing essentials just to get both food on the table and gifts in their stockings is not a “merry” Christmas. French luxury designers and auto manufactures already see weak spending, and they’ve been forecasting weak 4th quarter earnings.

*

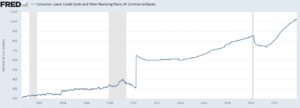

On the topic of credit, we Americans love to use it. Whether through credit cards or BNPL, credit usage has never been higher. Below you can see the trillion plus dollars in outstanding credit we breached this year.

**

Now, borrowing more isn’t always bad. The banks and wealthy do it all the time. The issue at hand is the ability for average consumers (the main users of credit cards and BNPL) to service their debt and not default on payments.

Since the end of 2021, consumer delinquency rates have nearly doubled. As financing grows, so does the failure rate to pay it back. So, when we see a historically strong holiday shopping season reliant on credit, we expect a corresponding rise in defaults.

We obviously don’t agree with the strong consumer narrative and would caution the sanguine view on the macro economy being touted by officials. Credit is just one part of equation, but with weakness in the air, we aren’t ready to celebrate with milk and cookies just yet. Unemployment data this Friday could be a turning point with a 4.1% or higher print triggering the Sahm rule for recession.

* Source: Adobe Digital Insights

** Source: Board of Governors of the Federal Reserve System (US)

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com