By Kelvin Lee

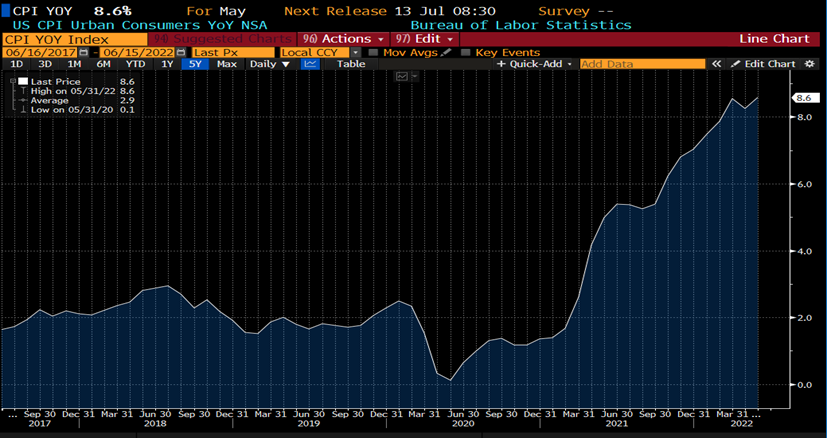

The Federal Open Market Committee (FOMC) will announce their decision to raise interest rates today at 2pm in Washington D.C. Today’s decision comes after the high CPI print last Friday indicating that consumer prices rose 8.6%, the highest in 40 years. The Fed walks a delicate tightrope in today’s meeting as its forward guidance in May of methodical 50bps rate increases may not be enough to combat elevated inflation. Markets are now anticipating and pricing a 75 basis-point increase following Friday’s data and chatter from the Wall Street Journal. Federal Reserve chair Jerome Powell has stuck by the Fed’s dual mandate: price stability and employment. With rising year over year inflation numbers, the justification for a more aggressive rate hike today by Powell is compelling. A more hawkish decision today would pivot from the Chairman’s guidance in May. Our base case is a 50bps hike with our models indicating a 60% chance of a 75bps increase in the Fed Funds Rate today. Our main concern is the effects of a 50 or 75 basis points increase on 2022 margins and continued upward rate pressures. The Fed is balancing recession odds with the expectations of lowering inflation, however a “soft-ish” landing may be possible as the market and economy adjust to a higher rate environment.

* Source: Bloomberg

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com