By Kelvin Lee

Arguably one of the markets most anticipated prints, the July Consumer Price Index (CPI), releases Wednesday. Investors will be watching to see if inflation has peaked. The federal reserve will be looking to see if they’re pouring either champagne or a tonic on the rocks. And our office will be putting overtime to tweak our terminal rate predictions. But let’s look at how to accurately read tomorrow’s print and what you should expect.

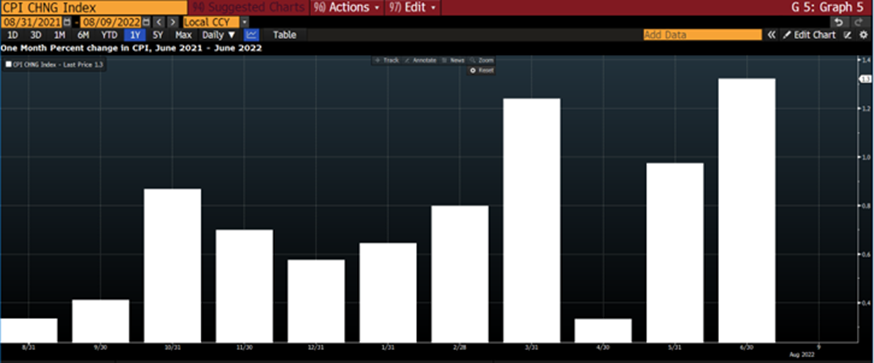

Here’s a summary of CPI from the U.S. Bureau of Labor Statistics,” The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services”. The change over time is presented as a month over month (MoM) and year of year (YoY) measure. The headline number will be YoY, which tells how much prices have changed since July 2021. The basket of goods used includes a host of categories, with food, rent, and fuel being the largest contributors. Our anticipation is that we’ll see a decrease in CPI tomorrow due to the food and fuel component. Oil and raw commodity prices came down significantly since the last print, so we’d expect the overall index to decline given the overweighting of those sectors. However, the federal reserve isn’t too concerned with nominal numbers, but instead focus on core CPI. Core CPI is the index without food and gas prices. Why? Because commodity prices tend to be volatile, take this year as a good example, and, as we mentioned in prior posts, the fed can’t control those prices. This is where inflation can be sticky and lag behind the immense interest rates hikes we’ve seen this year. Rent and services are going to be the key drivers here for core. Last month, the rent component of the index rose .8%, the largest since 1986. The strong wage growth and employment numbers we saw earlier are also signs that service pricing may also peak again for another month (remember companies need to pass on higher wage prices to consumers). Regardless of the nominal report, another core cpi increase tomorrow gives the Fed more reason to be hawkish and justifies a 75bps hike in their next meeting.

* Source: Bloomberg

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com