By Kelvin Lee, Alonso Munoz

Hedge funds often have a sumptuous association with them. They recruit the brightest minds on Wall Street and have the freedom to pursue a multitude of non-traditional and quant strategies for their wealthy clients. They’re focused singularly on one thing, and that’s generating alpha. Double digit returns constitute the minimum bar. So, is the typical non-accredited retail investor missing out on ridiculous outperformance that hedge funds can offer?

Not entirely. There are two considerations here. First, and as you would expect, the hedge fund environment can best be described as a big head and long tail. There are a few massive billion-dollar funds followed by many smaller ones with the performance varying significantly from one to another. Simply put, some strategies work and some don’t. The only common attribute being these strategies are of higher risk. Often, you’ll find the initial size of the fund can be as important to longevity as the managers running it. More assets mean more opportunities, more leverage and (sometimes) more avenues for success. It’s the pareto distribution, but lest we forget, even large Tigers can turn into house cats. Just putting your money in a “sexy” (shoutout to Blake) hedge fund doesn’t equate prosperity.

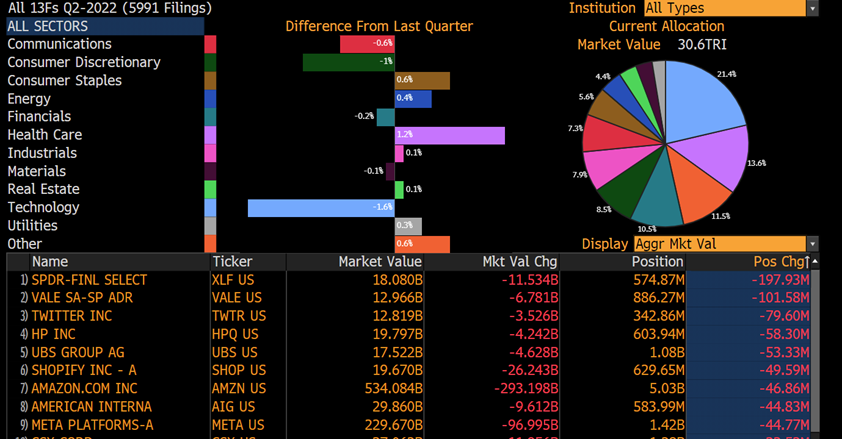

Second, hedge funds can be wrong! No surprise there and being wrong for a hedge fund is worse than being wrong for the average investor. Hedge funds are focused on creating maximum returns in the least amount of time. That shorter time horizon doesn’t give them the benefit to hold onto losing positions. They must have the liquidity to cover margin calls, investor capitulation, and to take advantage of newer dynamic plays. Hedge funds need to be market timers, which is where a lot of the downside risk is. On Monday we looked at the latest second quarter 13F filings from U.S. hedge funds to see how well these market timers did. Sidebar, the 13F is a report for investment firms with over $100 Million in securities AUM. The U.S. SEC requires them to disclose their equity holdings within 45 days of each calendar quarter. Most funds report on the last day to hide their strategies. Aggregately, we see hedge funds ended up selling out of growth tech stocks during the second quarter. That was the worst year to date quarter for those positions. Given hindsight, the strategy didn’t work. They sold low and since the beginning of July, the broad indexes have recovered more than 13%. In this case, a lot of Hedge fund managers lost out on the rally and locked in losses that longer term investors didn’t. With the return of the meme-stock mania in recent weeks, hedge fund shorts in those equities are another source of bleeding.

Overall, we would like to remind our audience that hedge funds are a high risk and high reward strategy and don’t always work. Don’t confuse their exclusivity with performance.

* Source: Bloomberg

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com