By Kelvin Lee, Alonso Munoz

The financial spotlight this past week has been on New York Community Bank (NYSE: NYCB) with its rather disappointing earnings for Q4 2023. Since reporting last Thursday, NYCB’s share price has tumbled more than 50% (congratulations to any short sellers out there), and the market is having Déjà vu from regional bank collapses last year.

What Happened?

Let’s first run through the disastrous earnings that led to the declines. Besides missing earnings and revenue expectations, New York Community Bank saw net charge-offs (loan delinquencies) spike from $24 million to $185 million over the last quarter, more than the combined net charge-offs for the bank over the past 10 years. The reason for the weakness? Commercial real estate (or CRE – which includes offices and retail properties). NYCB charged off two large office-backed debts, and the number of CRE loans that were past due jumped 48% during the third quarter. As a result, NYCB increased their provisions for future delinquencies from $64 million to $552 million, a more than 9-fold increase.

“Given the impact of recent credit deterioration within the office portfolio, we determined it prudent to increase the allowance for credit losses coverage ratio,” said New York Community Bancorp.

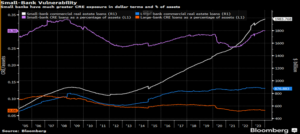

Now to be fair to NYCB, they did acquire some unsavory assets from the now-defunct Signature bank, which raised their assets past $100 billion, triggering more stringent capital requirements by the FDIC. While that certainly contributes to the spike in loss provisions, credit deterioration in their real estate portfolio is what’s concerning. Moody’s cut NYCB’s rating to junk, citing the bank’s CRE lending, unanticipated losses on office holdings, and multifamily property exposure resulting in potential confidence sensitivity. Mid-size lenders like NYCB struggle to shield delinquency risks as well as their larger counterparts, which rely on other credit and IB businesses to insulate weakness. That’s bad news when the market narrative focuses on smaller banks that are disproportionately exposed to CRE loans. In the chart below, smaller banks have 3x the exposure CRE loans as compared to large ones.

*Source: Bloomberg L.P.

CRE Harbinger

One reason for the volatile reaction on Wall Street is the potential alarm that NYCB is sounding on the office real estate market. If borrowers can’t pay their loans, then what does that mean for CRE? Over the past year, there have been roughly $1 trillion in losses in office real estate. The work-from-home revolution has hit cities hard, resulting in record vacancy rates for office buildings. Fewer tenants mean less income, causing property values to plummet.

Falling prices also hurt a landlord’s ability to borrow. As the property value drops, the loan-to-value ratio increases, and as a result, the owner must put more cash into a property deal to satisfy their terms of debt. If they can’t add capital, they’ll be forced to sell assets in a falling market. The negative feedback loop then continues with more forced dispositions, causing lower prices. Now, typically, owners can just borrow the cash they need, but with high-interest rates, financing is expensive. With over $2.2 trillion of commercial property loans due in the next 2 years, there’s an obvious risk that borrowers won’t be able to refinance and default on their current loans, i.e., NYCB’s situation.

Also, in CRE, it’s important to look at valuations. Look, real estate, in general, isn’t as transparent in pricing as bonds or equities (public markets). Commercial prices look at estimated yields, potential occupancy rates, and are driven strongly by comparable transactions. Well, unsurprisingly, transaction volumes have fallen drastically over the last 12 months (people don’t like selling at a loss), which means comps are unreliable. All this is to say that the correct valuations of offices may be lower than what’s currently reported. This could be a case of “you can’t handle the truth”, so our team is underweight CRE exposure.

In conclusion, our firm sees a lot of similarities with last year’s regional bank collapse. Instead of long-duration bonds falling in a high-interest rate environment, it’s commercial real estate prices. We anticipate that other overexposed regional lenders will have similar issues as NYCB, especially if more and more defaults come in. It’s not only us taking a tepid approach to CRE in general. Early last week, Treasury Secretary Janet Yellen warned legislators about commercial real estate losses, and that U.S. regulators are proactively working with banks to prevent a potential liquidity crisis.

“Valuations are falling. And so, it’s obvious that there’s going to be stress and losses that are associated with this,” Yellen said.

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com