Inflation, Inflation, Inflation…

By M. Blake Fortune, II Lately, the financial media seems to only talk about one thing: inflation. Since the onset of the Covid-19 pandemic and, subsequently, fiscal, and monetary stimulus programs launched in an effort to stabilize the economy, investors have worried about long term consequences of the “easy money” policies. What is inflation, why […]

2021 Defining Moments

Defining moments in 2021: January In late January, the meme-stock saga began. AMC, GameStop, Blackberry, and stocks of companies that were nearly bankrupt, rallied on the backs of “amateur” day traders. As a result of the rapid price appreciation, hedge Funds and other institutional investors had to cover large short positions, driving up prices even […]

The Omicron Saga

The past 5 trading days were volatile. It seemed as if market participants were waiting for some form of bad news to justify selling portfolio positions. And they got it with reports of a new Covid variant dubbed Omicron. The tech heavy NASDAQ Composite was off more than -2.5% last week. The 10-year government bond […]

Actionable Guide for the DIY Investor

Acting on personal finances is often one of the most difficult things to do. Hamilton Capital Partner’s “Accelerated Freedom Program” provides actionable and transparent advice to help young professionals build wealth. Below, we have provided several bullet points that can help guide “DIY” Investors: Automate your savings and investments. Although it sounds simple, we often […]

Investing like the Atlanta Braves

Good Morning and happy Thursday! I’ve remained a loyal supporter of my sports teams for many years- through thick, thick, thick and thin. Alonso has been relentless in his daily reminders of the Atlanta Falcons blowing a 26-3 halftime lead in the 2016 Super Bowl. I have convinced myself (for better or for worse) […]

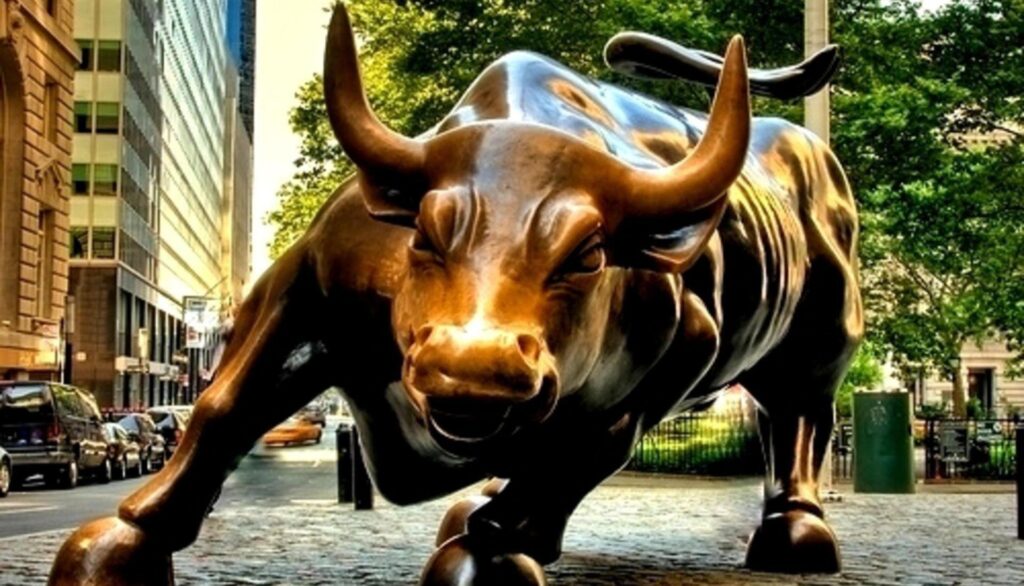

What’s Next for the Stock Market……

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful”– Warren Buffet September was a brutal month for equities. In fact, September saw the S&P 500 post its worst monthly performance since March 2020. Headwinds consisted of domestic and international political uncertainty, as well as an […]

Washington’s $3.5 Trillion Proposa

It would be an understatement to say that there is ALOT going on in Washington, across the nation and around the world. This week, headline reports have been dissecting Washington’s proposed spending package that could be linked to the national budget, known as reconciliation. What is budget reconciliation? When Congress proposes a reconciliation bill, it […]

Looking Ahead to Q4

September 22, 2021 In the U.S. and abroad, investors are navigating choppy markets yet again. Global markets started the trading week deep in the red, with domestic exchanges plunging on news that the Chinese real estate conglomerate, Evergrande, could be nosediving into a debt crisis as it comes up on $300,000,000,000.00 in interest payments. On […]

Jackson Hole Economic Symposium

Happy Friday! Jerome Powell spoke to economists, market participants, and government representatives this morning at the annual Jackson Hole Economic Symposium. Historically, the annual conference has been used by Fed chairs to make important announcements regarding the future direction of monetary policy. Mr. Powell’s remarks this morning seemed to be in line with what investors […]

The $1 Trillion Infrastructure Package

After weeks of negotiations, and with broad bipartisan support, the Senate is expected to pass a $1 trillion infrastructure package today. How will some of the proposed $1 trillion be spent? Lets break it down: 1) ~$110 billion towards roads and bridges 2) ~$66 billion towards rail (heavy and light) 3) ~$40 billion to transit […]