By Kelvin Lee

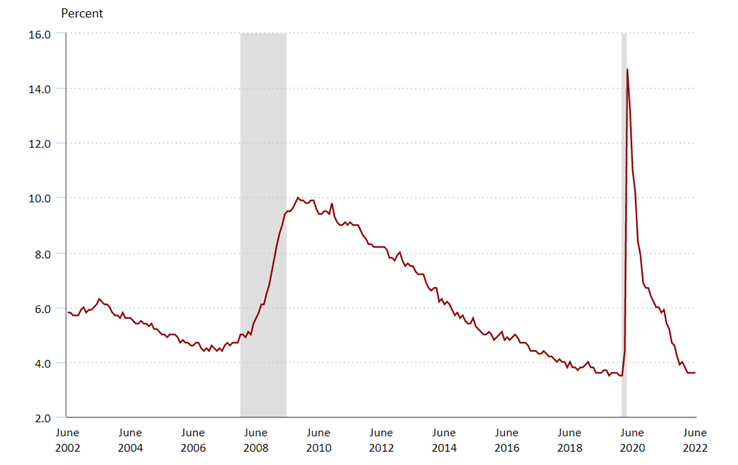

WE ARE IN A RECESSION! But not really…. Second quarter GDP numbers came out yesterday with a downside surprise of -1.6%. While this satisfies the common definition for recession of two consecutive quarters of GDP decline, we only see the print as achieving a restricted measure of the term. Why? Well first, it’s the National Bureau of Economic Research (NBER) that officially declares a recession, and they haven’t yet for good reason. Their classification is a “significant decline in economic activity that is spread across the economy and that lasts more than a few months”. The key term is “significant decline”. A slight decline may mark the beginning of a slowdown, but it doesn’t cross the threshold, especially when the first quarter GDP print was a justified reaction following the overheated expansionary cycle during Covid. The -1.6% report isn’t even as awful as it seems. Analyzing the real GDP formula shows that GDP deflator is factored in. That means it’s inflation dependent, so you can increase real GDP by either growth or lowering inflation. In this environment, the fed is supporting the latter. The Federal Reserve raised rates by another historically large 75bps (basis points) Wednesday in their mandate to fight inflation. If our inflation prediction this month is correct, and that CPI has peaked, we would expect the GDP deflator to decrease. Also consider the labor market: it’s uncharacteristically strong for this macro environment. Unemployment currently sits at 3.60%, and we still have 2 open job positions for every unemployed person. Wages haven’t fallen as a result, indicating consumers still have resilient balance sheets to buy and consume. Just today, we saw month over month personal income and personal spending grow. Those numbers simply aren’t representative of past recessions, as displayed below. Simply put, while you may hear that we are in a “technical” recession, the data indicates that we aren’t in one just yet.

U.S. Civilian Unemployment Rate- Past 20 Years

* Shaded area represents recession as determined by the National Bureau of Economic Research

** Source U.S. Bureau of Labor Statistics

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com