By Kelvin Lee

Before I begin, I’d like to remind the audience that its crucial to have a longer-term investing outlook and that economies are cyclical; downtrends are both healthy and inevitable. That being said, I want to explore the view that we still are in a bear market.

Markets are currently pricing the terminal rate to be in a range of 3.25% – 3.50%. In my view, that’s an overly optimistic fed funds rate which doesn’t adequately consider how sticky inflation can be and how strong the labor market currently is. Nominal inflation has peaked, but the downside surprise in the last print originated from falling oil prices rather than core components (see our write up here). Services and rent are still at extremely elevated levels and won’t decline as fast as many anticipate. We are in a true period of quantitative tightening, experiencing rate hikes and balance sheet reductions not seen since the last century. The central bank won’t be here to help investors this time. They are focused entirely on fighting inflation, and given their 2% inflation target, they have much more work to do. I think investors are underestimating how far the central bank is willing to go. They have a narrative that the Fed will pivot from its policy tightening stance and start cutting rates in early 2023. I’d imagine that some reserve members find that claim ridiculous as the data indicates otherwise. Wages are still growing, the labor market is still tight, and consumer prices are still high. Also considering the lag effect of monetary policy that Milton Friedman championed, we haven’t seen the full effect of quantitative tightening yet on the economy. Thus, the gap between bullish investors and the Fed’s reasoning is my concern as a correction could be needed. When you price in the best-case scenario of a light recession and soft landing, you can only see downside as data rolls in. This Friday, we’ll get more insight from Jackson Hole in Wyoming, but the anticipation for a hawkish Powell isn’t positive news.

On the equities front, forward guidance hinted at a broader economic slowdown. More than 40% of S&P500 constituents had down revisions in earnings and revenue last quarter. While most firms did beat 2Q expectations, CIO’s voiced their concerns on inflation and wage growth pains. You might have noticed that many blue-chip companies have already started trimming their labor force in anticipation. Falling corporate margins showed firms failed to pass down rising costs to their consumers, even with stronger revenues. While some cite current robust consumer balance sheets and spending potential, I would argue that those cash reserves are dwindling. Inflation is outpacing wage growth, and consumers are relying more on credit. That’s going to be a headwind for many firms going into 2023.

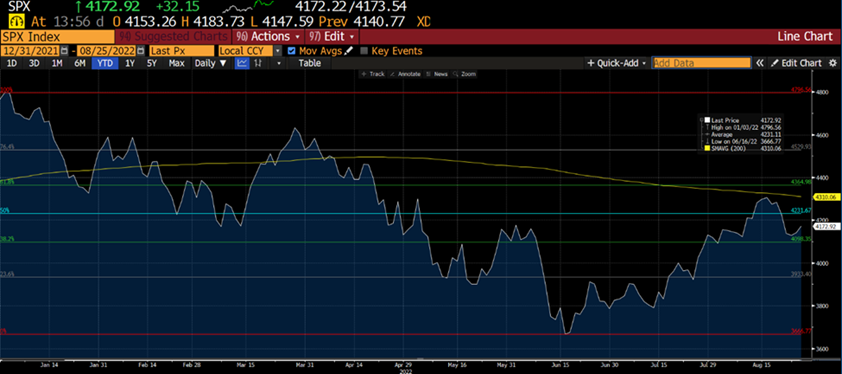

On the technical side, l saw a few key signals pointing to an overall down trend in the S&P500. The rally we saw over this past quarter was not convincing of a new inflection point. According to BOFA chief investment strategist Michael Hartnett, “The average S&P 500 gain in 43 bear market rallies of more than 10% going back to 1929 is 17.2% over 39 trading days, while in this case, it is up 17.4% in 41 days, making it a “textbook” example.” The rally failed to stay above the 50% retracement level and breach the important 200 day moving average, both suggestions that markets are working in a broader decline.

As I mentioned in the introduction, economic contraction is necessary and rising interest rates are a good thing. When money isn’t free, unprofitable companies with unsustainable business models are appropriately punished. In this environment, we can adequately focus on firms with strong cash flows, competitive advantages within industry, and regenerative product lines.

* Source: Bloomberg

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com