By Alonso Munoz, Nick Kelly

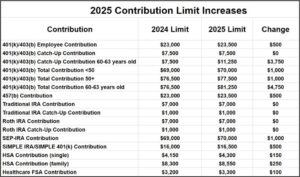

The news is out! The IRS has increased the 401(k)-contribution amount to $23,500 for 2025, while keeping IRA limits the same.

As we close out a great year, Pensions and Plan Sponsors will start to prepare for 2025, and workers/Plan participants should do the same.

For 401(k) contributions, there will be a slight increase of $500 dollars to a max contribution of $23,500 for participants under 50 years of age. The catch-up contributions will remain unchanged, with participants over 50 years of age able to make a catch-up contribution in the amount of $7,500, however, for individuals aged 60-63, their catch-up contribution (super catch-up contribution) is slightly higher, up to $11,250. Although the increases for 2025 were not large, Plan sponsors and participants should review their 401(k) and benefits for any opportunities to save more for retirement!

Pending Secure Act 2.0 changes: As we look forward to 2026, it’s probable that high-income earners (those with over $145,000+ in wages) will be required to make their catch-up contributions to Roth accounts vs the current choice of Pre-Tax or Roth.

401(k) Contributions

- For 2025, the contribution limit to 401(k) Plans has increased to $23,500.

- In 2025, the 401(k) catch-up contribution limit for those over 50 will remain $7,500 as in 2024.

- However, investors age 60 to 63 can save $11,250 for catch-up contributions based on changes enacted via Secure Act 2.0.

- These limits apply to other workplace Plans, including 403(b)s, most 457 plans, along with the federal Thrift Savings Plan.

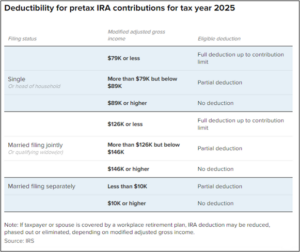

Individual Retirement Account Contributions

- The maximum contribution to IRAs in 2025 is $7,000 – unchanged from 2024.

- IRA catch-up contributions for those over 50 years old are also remaining the same at $1,000.

- These limits apply to both traditional and Roth IRAs.

New 2025 IRS Retirement Plan Contribution Limits [Including 401(k) & IRA] | White Coat Investor

401(k) contribution limits for 2025

401(k) catch-up contributions limits 2025

Roth IRA income limits for 2025

The opinions expressed in this commentary reflect the personal opinions, viewpoints and analyses of Hamilton Capital Partners, LLC (“HCP”) and are subject to change without notice. Such comments should not be regarded as a description of advisory services provided by HCP or performance returns of any HCP client. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. The third-party material presented is derived from sources HCP consider to be reliable, but the accuracy and completeness cannot be guaranteed. Hamilton Capital Partners, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Hamilton Capital Partners, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request.