The past 5 trading days were volatile. It seemed as if market participants were waiting for some form of bad news to justify selling portfolio positions.

And they got it with reports of a new Covid variant dubbed Omicron.

The tech heavy NASDAQ Composite was off more than -2.5% last week. The 10-year government bond yield pulled back nearly 25 basis points as investors sought some form of safe haven.

High Frequency traders and algorithms amplified the sell off.

The next big question for investors will be whether or not future policy action by the Federal Reserve will help “normalize” capital markets.

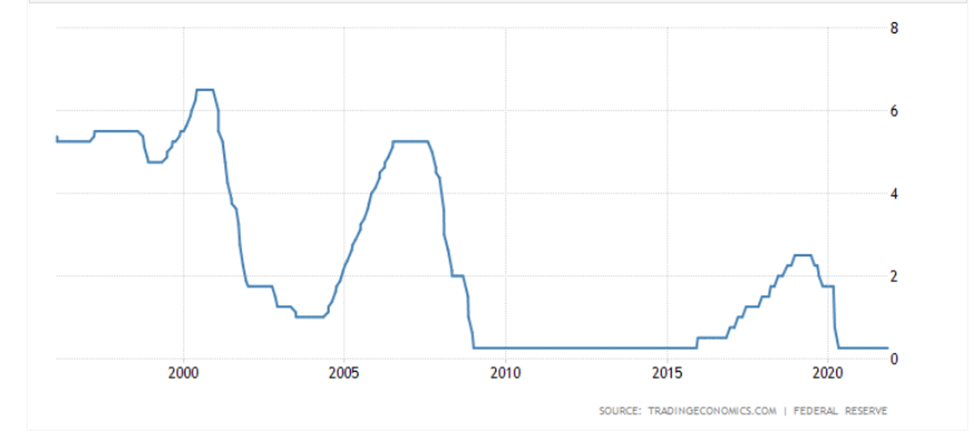

Prior to the 08 financial/credit crisis, then Federal Reserve Chair Greenspan hiked rates from ~1% to ~5% (see chart below). Raising the fed funds rate, however, did nothing to help steepen the yield curve. Long bond yields remained relatively low and helped inflate the housing bubble.

Today’s market feels slightly similar to 2018, when Fed Powell raised the fed funds rate to ~2.5%, while at the same time shrinking the Fed’s balance sheet. Everybody remembers the near bear market that resulted through Christmas Eve!

As we move through December, many of the “known unknown’s” could shake themselves out and investors will have a better understanding of the current state of labor markets and future Fed policy decisions.