By Kelvin Lee, Alonso Munoz

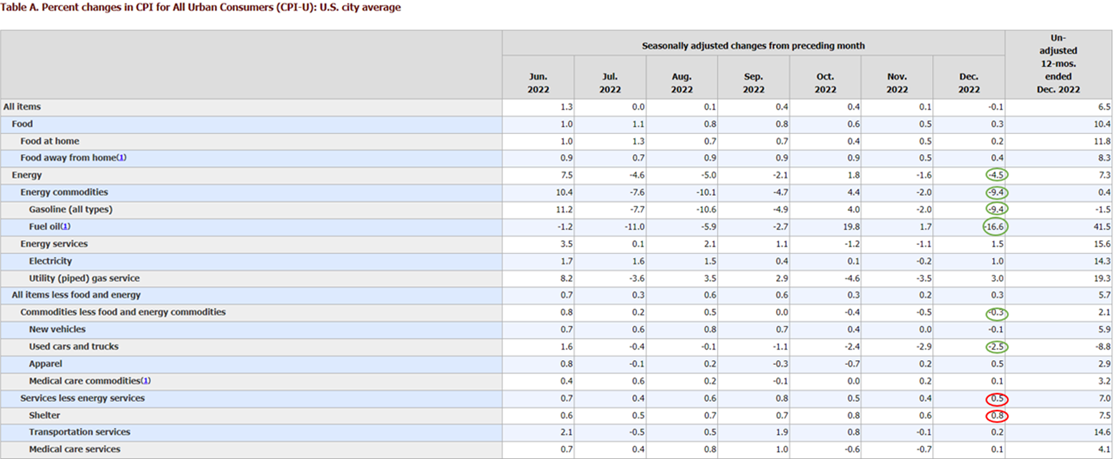

Today’s headline CPI print, which covers the month of December, shows another third straight month of decline in inflation. Investors are likely to be happy as the deflationary number gives the fed conviction to slow their pace of rate hikes; however, we would caution frontrunning a positive reaction to the news. Dissecting the CPI print below, you can see how the fall of energy and goods prices contributed substantially to the .6% decline from last month. Energy declines likely took 50 bps of the monthly headline. Categories more pertinent to the Fed moved upward. Rent and core services, a category that Fed Chair Jerome Powell noted as the one metric to watch for durable disinflation, continued to rise from the month prior. While the overall print does show downward trend in CPI, there is still work to do in order for the fed to reach their 2% goal, and, given how sticky core CPI is, expect 25bps hikes for the next two meetings.

To contact the author of this story:

Kelvin Lee at kelvin@hamiltoncapllc.com

To contact the editor responsible for this story:

Alonso Munoz at alonso@hamiltoncapllc.com

*Source: U.S. BLS